Top Forex brokers correspond to certain criteria that are defined by traders and are determined by clients’ interests. These criteria are based on different aspects, starting from services to trading conditions brokers offer. Learn more about What is Forex Broker.

Why Are Top Forex Brokers Regulated?

Being regulated is one of the primary factors for brokers to insure trust and reliability among clients. However, among numerous Forex brokers, widely spread around the world, there can be found such companies that are scams and try to cheat on their customers. Thus, regulation of the activities is one of the major factors, providing reliability of the provided services.

Trustworthy regulatory authorities provide this service.

IFC Markets, which is a member of IFCM group, is licensed by the British Virgin Islands Financial Services Commission (BVI FSC), Certificate No. SIBA/L/14/1073.

What Conditions Do Top Forex Brokers Provide?

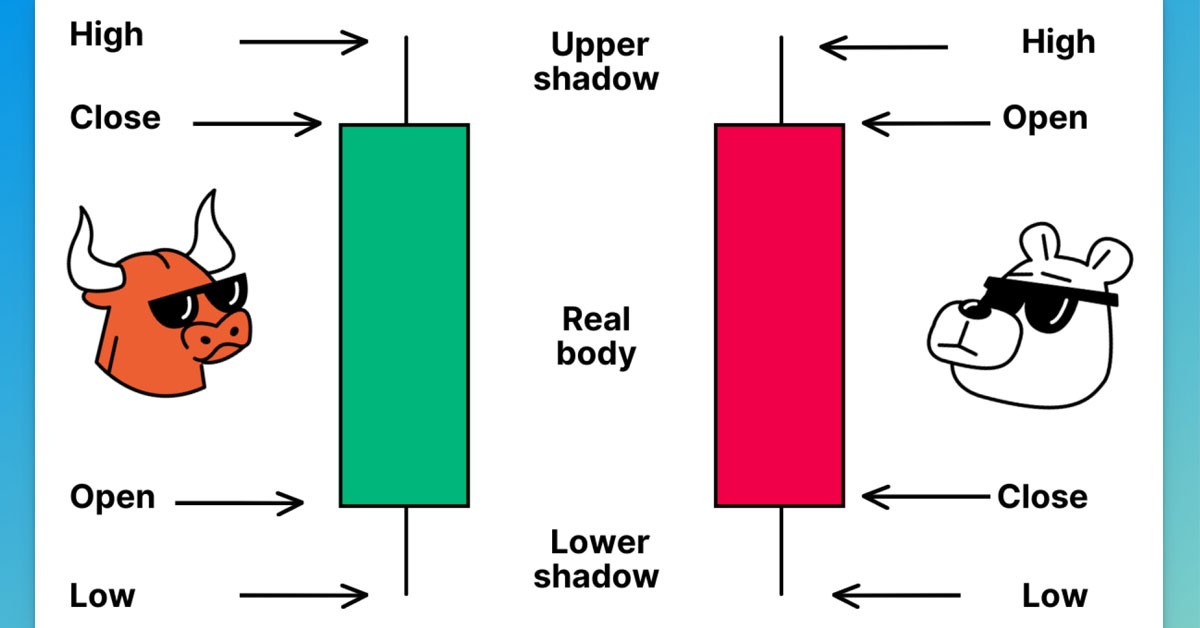

- Fixed low spread: The spread is the difference between bid and ask prices at the given moment. Top Forex brokers usually offer their clients fixed spread which does not change in case of changes of market conditions and its volatility. This feature of the spread makes trading more predictable, decreases risks and protects traders from high market volatility. IFC Markets provides spreads on major currency pairs from 1.8 to several pips.

- High leverage: Leverage is the ratio between the actual capital on trader’s account and the total capital offered by the broker. For instance, the leverage of 100:1 means that the broker would lend you $100 for every $1 of your actual capital. Generally, online Forex brokers offer leverage starting from 50:1 up to 1000:1. However, offering extremely high leverage is not always beneficial for traders. That is why most good brokers that are considered top Forex brokers do not offer significantly high leverage. IFC Markets offers its clients leverage up to 1:400 which allows traders to get high profit.

- High leverage may increase both the potential profit and the potential loss. Those who have limited capital try to take high leverage to get substantial profits, but they should not forget about the danger that comes with high leverage.

- Learn more about What is Leverage in Forex

- Optimal swap conditions: Swap is the operation of transferring the position to the next day for which Forex brokers charge or pay a certain amount based on the direction of transaction, its volume and the interest rate differential between the two currencies involved in a transaction.

- Top Forex brokers thoroughly acknowledge that the higher the rate for the currency purchased and the lower the rate for the currency sold, the more beneficial the position rollover will be. Therefore, based on this notion, they try to provide their clients with significantly good terms.

- IFC Markets offers its clients one of the best Swap conditions in the market; that is why traders can hold their positions open for quite a long time. Zero Swap principle for Stock CFDs operates. Swaps for the currency pairs and other assets are based on interbank interest rates.

Experienced Forex traders consider a Forex broker as their principal business partner and make their choice with much care and caution. Though top Forex brokers provide wide set of services and good trading conditions, to find the one with the best conditions is still difficult. When making a decision each detail of its offers should be taken into consideration.

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with CFD and Forex trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 and MetaTrader 5 platforms available on PC, Mac OS, iOS, Android, Windows Mobile and Smartphone. You may compare the advantages of each platform.