I am going to talk about trading Forex during news events today.

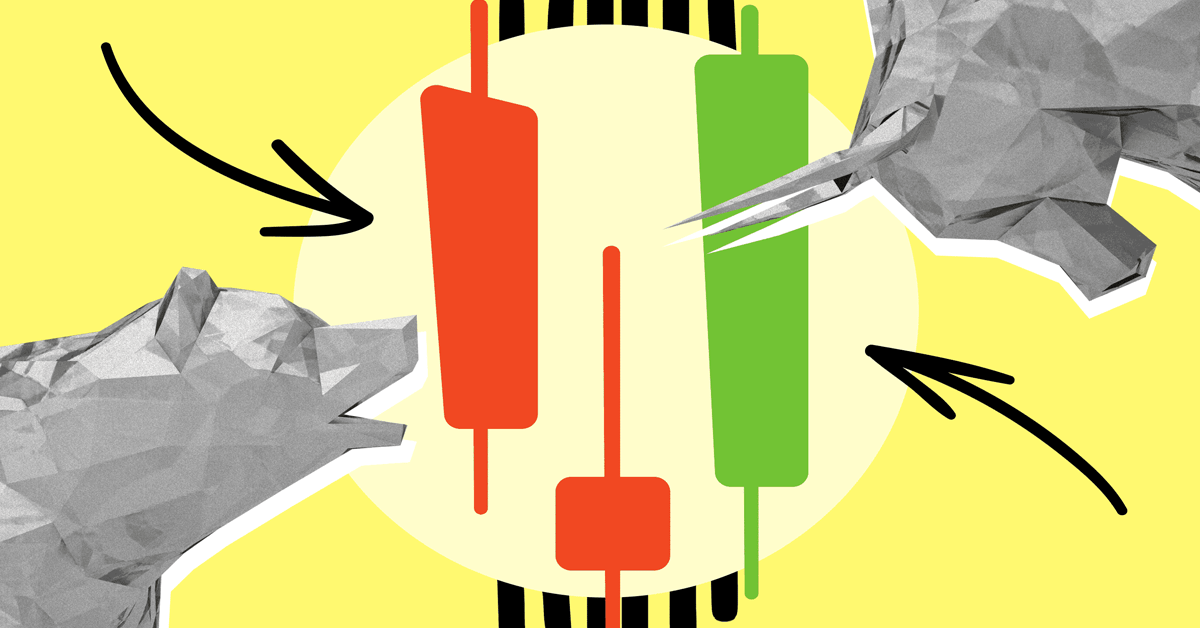

Trading news strategy is a quite dangerous way to earn money actually, but many traders are getting caught up, because they really want to trade these big shifts in prices, caused by news. And let’s be honest, it's a very tempting idea to figure out the price direction caused by a news event and ride it.

But everything is not that simple and clear, a lot of times what traders try to, is when the news is set to release they put long and short positions above and below price and try to catch the direction the market goes, so when the price jumps up they go long and ride the momentum, and vice versa. But this approach is not very clever, to say at least, let me tell you what is really happening in that situation:

Well there are too many traders out there that also know about the news event and that the price is going to spike, brokers are also aware about that, so what actually happens, brokers increase bid/ask spread. During news, brokers want to reduce their exposure to the market volatility, so they drastically increase spread to kind of protect themselves. It’s not because brokers are evel, people often say it’s because brokers are trying to scam traders, but the reality is quite simple, brokers are covering themselves, from market big swings.

The problem with this approach is as you already guessed, even though you are placing the right order, the spread is quite wide and traders, if they are lucky, profit very little if any. News event’s caused spread widening is called slippage, which happens from time to time.

Now that we’ve covered how not to trade during news events, let’s go ahead and check out a more controlled way of profiting from news trading.

We are going to wait for after the fact (price spiking up or down).

You can see on the chart, we are interested in the after part, often after news releases we do see some drift back, as a correction.

Our next step would be drawing fibonacci retracement from the low of the price to the highest it went after the news release, to see potential structure of the price when it will start to correct down. At the highest of the price, we can see that some traders are starting profit taking, other day traders shorting or investors making the move etc.,

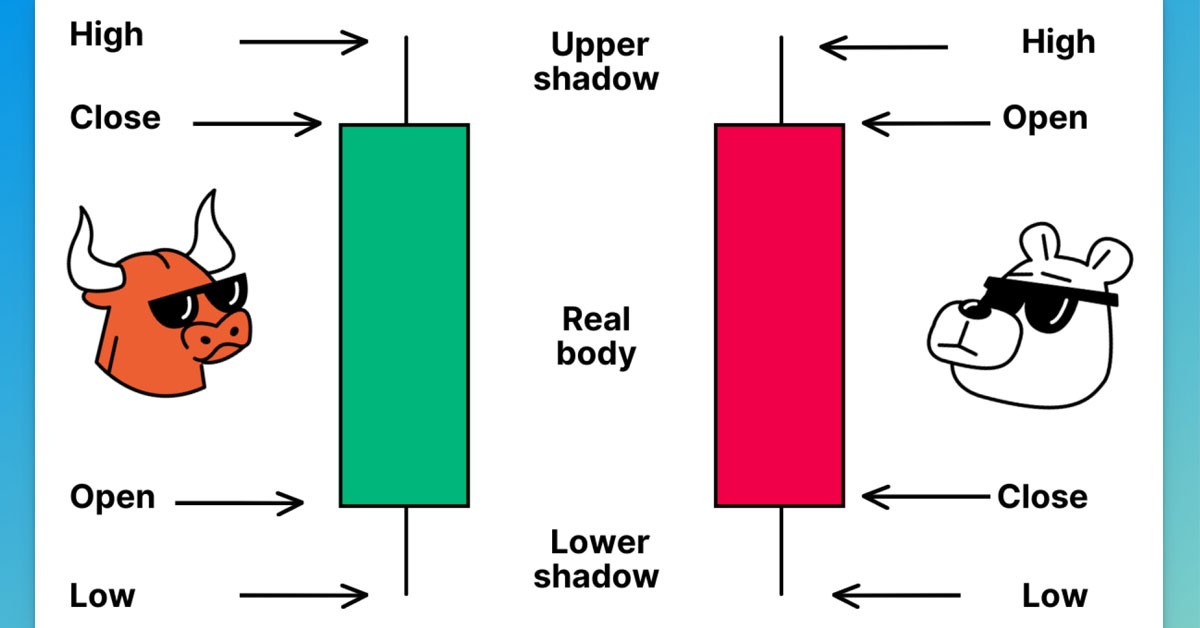

So how we can actually trade this, is to look for signal that market is actually starting to roll over, one of the ways is to look for lower lows and lower highs, or look for confirmation of price drifting down using candlesticks patterns, in this case, we have a shooting star, which means that sellers were able to push down the price and there is a selling pressure. We could set up a seller position after the shooting star candle.

We are going to place the stop just above the area of the resistance, you can see on the chart and take profit place 1 to 2 risk reward ratio. Our take profit would be around 61.8 level on Fibonacci retracement (level of resistance).

Here we would have a very nice profit from trading news fading. Of course this strategy, as any other doesn’t work every time, you need to have a set of rules or conditions before opening positions and of course good risk management, meaning reasonable R/R, your risk tolerance % of your equity you prefer to use on each trade, and good mental resilience.

Always backtest the strategy before trying it on a real account.

If you’ve liked the strategy go ahead and test it.

Good luck!