Hey there,

Ready to take your chart analysis skills up a notch? Let`s dive into the "Double Top/Double Bottom Chart Patterns Test"! This test will help you understand and identify these crucial patterns that can shape your trading decisions.

Section 1: Introduction to Double Top/Double Bottom Chart Patterns

- What are double top and double bottom chart patterns primarily used for?

a) Identifying the best entry points for day trading.

b) Spotting potential reversals in market trends.

c) Predicting future stock prices with precision.

d) Finding hidden support and resistance levels.

- When does a double top pattern form?

a) After a bearish trend.

b) During a steady uptrend.

c) Following a market crash.

d) In a highly volatile market.

- What`s the key characteristic of a double bottom pattern?

a) Two peaks and one trough.

b) One peak and two troughs.

c) Three consecutive troughs.

d) Fluctuating prices without a defined pattern.

Section 2: Identifying Double Top/Double Bottom Chart Patterns

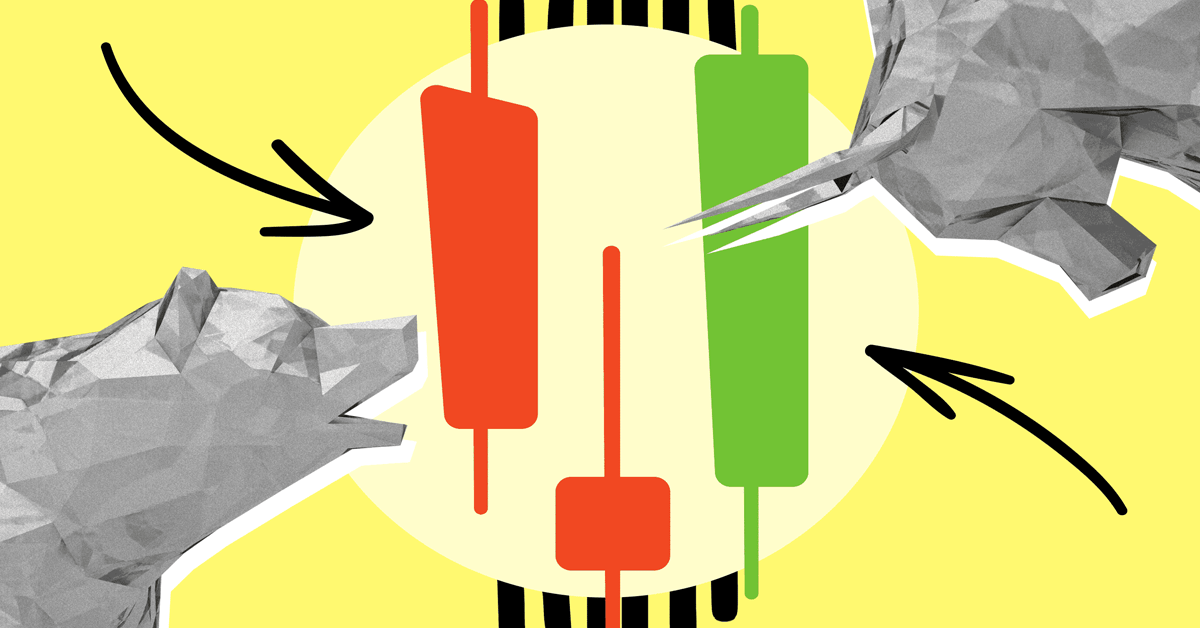

- Look at the provided chart image. What pattern is illustrated here?

a) Double Top Pattern

b) Double Bottom Pattern

c) Ascending Triangle Pattern

d) Falling Wedge Pattern

- Double top patterns often exhibit:

a) A higher second peak compared to the first.

b) Rapid uptrends with no consolidation.

c) A vertical drop in prices without warning.

d) Long periods of sideways movement.

- What`s the key role of the neckline in a double bottom pattern?

a) It indicates a potential bearish reversal.

b) It helps measure the depth of the pattern.

c) It provides resistance levels for trading.

d) It`s used to confirm the pattern`s validity.

Answers

Section 1:

b) Spotting potential reversals in market trends.

b) During a steady uptrend.

b) One peak and two troughs.

Section 2:

a) Double Top Pattern

a) A higher second peak compared to the first.

d) It`s used to confirm the pattern`s validity.

That`s it! Remember, this test is designed to help you improve your chart pattern recognition skills. Feel free to take your time, and let`s see how you fare in mastering those double top/double bottom patterns!

Now that you learned more about Double Bottom and Double Top chart patterns and can use them as a part of your trading plan when trading reversal strategy.

Go ahead and try it on your demo or real account.

Good Luck!

that was excellent . thank you