Entering the Forex market may seem quite easy at first sight, if of course, traders know what steps and measures to take to reach the best financial results. But in case of beginners, Forex market education first of all starts with the knowledge about Forex trading strategies. What are they needed for? Forex trading strategies are sets of analyses for traders to determine whether or not to buy a currency pair for a given period of time. Indeed, strategies vary a lot, and there is not at least one trading strategy that is assured to bring the best results. Mostly, the choice of a trading strategy depends on a trader’s personality.

Forex trading strategies: the basics

The classification of Forex trading strategies starts with the three main aspects of Forex market analyses:

- Technical analysis;

- Fundamental analysis;

- Market sentiment.

All of the above-mentioned types of analysis help to form trading strategies. They have different components and analysis tools which show the past or future market dynamics. And it is up to a trader which analysis to choose for higher income.

Forex trading strategies: the classification

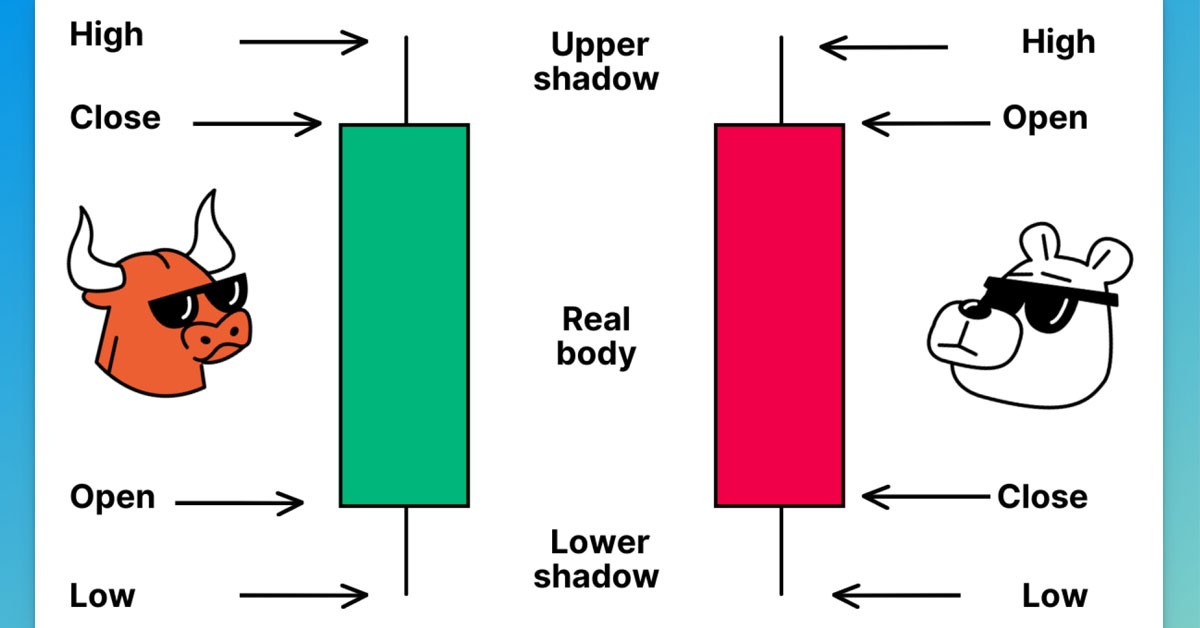

1. Forex trading strategy based on technical analysis concentrates on past market action, that is past prices and past volumes. Thus, based on past market action it uses technical analysis charts and tools to determine and predict the future market movements. Technical analysts strongly believe that market’s future performance lies upon its past activities.

There exists a number of Forex trading strategies based on technical analysis:

- Forex Trend trading;

- Support and resistance;

- Forex Range;

- Forex charts;

- Technical indicators;

- Forex volume;

- Multiple Timeframe analysis.

2. Forex trading strategy based on fundamental analysis focuses on the core reasons which may affect the market direction. The difference between technical analysis and fundamental analysis is that in the first case the analysts do not need to know the reason of changes, while in the second case, analysts go deeper to find out why the changes occur. Fundamental analysts mostly use long timeframes and the reason for this is that the data they need are emerged more slowly than the data used by technical analysts.

3. Forex trading strategy based on market sentiment reflects investors’ attitude to the market or a specific security. This means that in this case people’s expectations and feelings, hence how these make them act in the Forex market are taken into account. Market sentiment can be bullish and bearish: respectively, prices increase and drop for each case.

Trading strategies also depend on the trading style, which can be various as well: day trading, hedging, portfolio trading, spread trading, order trading, etc. Moreover, trading order types are also very important: market orders, pending orders, limit orders, stop orders, etc.

In conclusion, traders should always keep in mind that all the mentioned information is to be taken into consideration before starting to trade. Truly, trading strategies vary a lot. Traders should choose the strategy that suits their character and personality in the best way! Moreover, in the course of time, with the right information and enough experience they are free to develop their own trading strategy for more brilliant results!