Being the best-selling raw material in the world, oil attracts many investors, as its quotations are affected by economic indicators and political situations of the world’s largest states. At different times, various grades of oil were the basis for the global price formation, but since the ‘80s of the 20th century, the world started to focus on famous WTI and Brent crude oils, which compose only 2% of the world oil production. For more detailed information you can see our Brent vs WTI infographic.

Grades of oil

Mainly two standard grades, which differ in location and in particular features, are used for oil trading. Read more how to trade oil.

West Texas Intermediate (WTI) is a benchmark for oil with low sulfur content and low density produced in Texas (USA). It is mainly refined into gasoline and diesel fuel for the US market.

Brent is another benchmark for oil that is extracted from the North Sea on the British and Norwegian continental shelves. Brent is a combination of 15 types of high-quality crude oil and is mainly used in the EU countries.

Dynamics of prices

The price of oil has always been extremely volatile, although most often its dynamics was affected not by the ratio of supply and demand, but by the world political situation. In the ‘90s, it was worth from $11 to $25. Since the beginning of the 2000s, the price gradually rose and peaked on July 11, 2008 - $147 per barrel of WTI.

In connection with the global economic crisis a sharp decline of oil prices began – by December 2008, WTI was worth $26 per barrel. In 2009, the prices gradually started to recover and in 2012 reached $120. In 2014, with the oversupply of raw material in the market, the prices declined twice, and by January 2016, the price of Brent fell below $28.

Since the ‘80s, WTI was worth 2-3 dollars more expensive than Brent. The situation changed in 2010 when the USA started to produce large amounts of shale oil. European oil sharply rose in price, and the difference between these grades in 2011 was $27. In subsequent years, the difference gradually reduced, and at the end of December 2015, the prices of BRENT and WTI equaled due to the removal of the ban on the export of oil from the USA introduced in 1973.

Oil trading

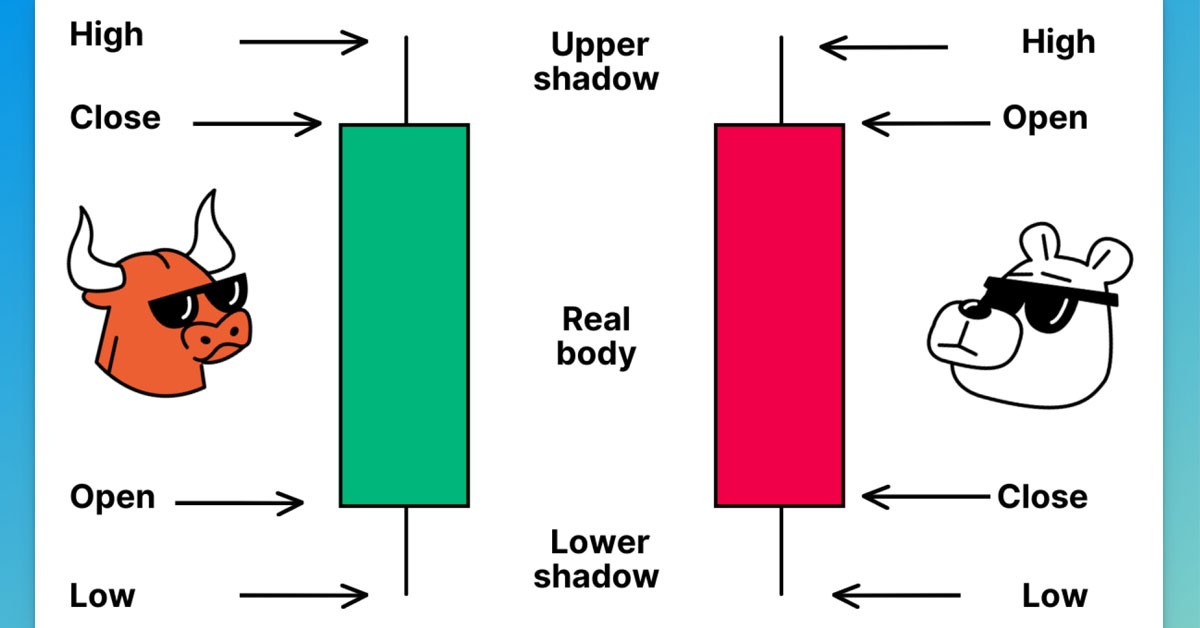

Online oil trading does not practically differ from currency trading, and the only difference is the small size of leverage. Trading is conducted through the purchase/sale of CFDs (contract for difference), the expiration dates of which are known to a trader in advance. After the expiration date, the contract is no longer valid, and if you have not closed the position yet, it will be automatically closed at the market price.

Besides the classic trade of one of the grades of oil, NetTradeX platform allows to create a personal composite instrument (PCI) – BRENT/WTI through GeWorko method. This instrument is intended for spread trading between the two grades of crude oil - Brent and WTI. In this case, Brent oil futures contract is the base, and the WTI oil futures contract is the quoted. The base and quoted parts of the PCI contain 1 barrel of Brent and WTI oils, respectively.