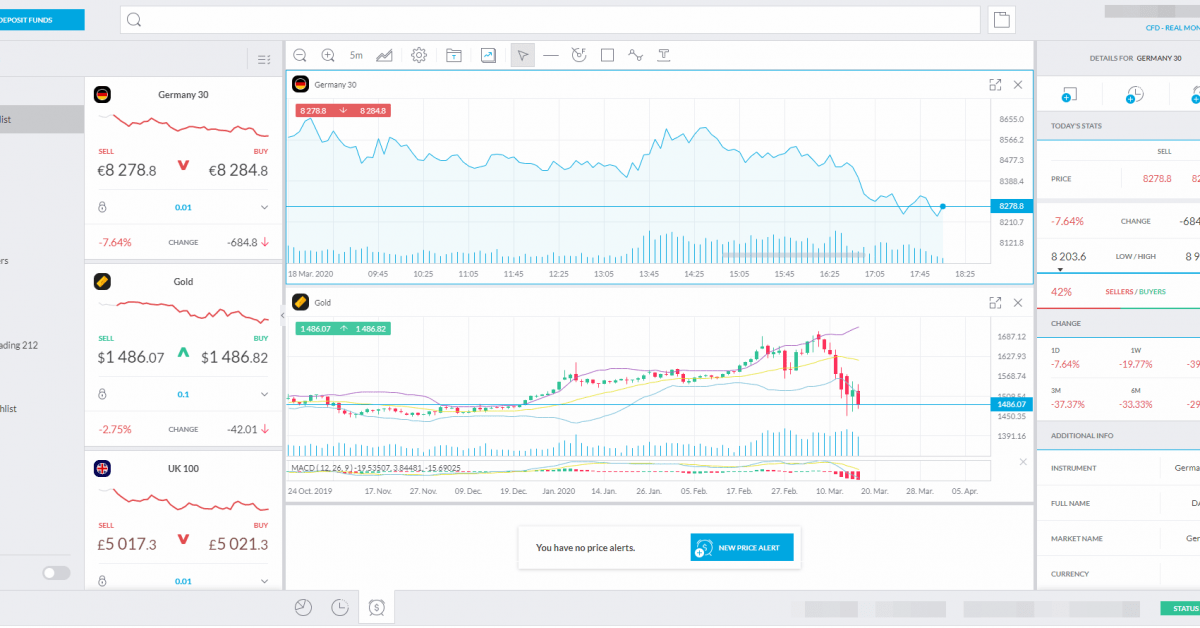

Brokerage Platform

A brokerage platform is defined as a software provided by brokerage companies, which gives the opportunity to perform trading activities and manage trading accounts. A good brokerage platform grants traders and investors with access to live quotes of various assets, thus enabling them to follow their price movements at that moment in time, numerous tools of technical analysis for predicting the market and making the right trading decisions, different charts, which play a significant role in trading, various types of orders and many more. Given the way that a trading platform has a great impact on the further outcome of trading, it is highly recommended to spend much time on the research of a reliable brokerage platform. Currently, there is a great number of brokerage platforms available and they all differ in functionality and interface style, but the matter is to find the one that will best meet your trading expectations.

Best Brokerage Platform

Every brokerage company offers one or more trading platforms to its customers, but it’s worth mentioning that a company providing its own developed brokerage platform is likely to have an advantage over the others. IFC Markers is one of those financial companies which has developed a completely new and advanced trading platform – NetTradeX. The trading-analytical platform NetTradeX was developed by IFC Markets, a leading Forex and CFD broker, in 2006. The brokerage platform has a complete set of features for trading on the Forex market and excellent opportunities for technical analysis. Now let us go through the advantages of NetTradeX.

- The opportunity of trading in all major financial markets;

- The opportunity of opening positions of any volume;

- The opportunity of getting the summery of traded volume per instrument;

- The opportunity of selecting and using the following orders: Market, Limit, Stop, Pending, Linked, Activated, Trailing Stop still active when your computer is turned off;

- The availability of various charts with individual settings and templates;

- Existence of NTL language for automated trading

- Instant execution of deals

- The opportunity of creating your own limitless financial instruments from a variety of available assets through GeWorko Method;

- The opportunity of getting the price history of the created instruments, which reaches up to 40 years

The platform is designed for both Forex and CFD trading. This means that now traders and investors do not have to open a forex brokerage account in different platforms since they can have access to all instruments in just one place. Through NetTradeX trading-analytical platform your trading will become even more enjoyable in terms of user-friendly interface and what the most important is more beneficial.