Hey there, let's dive into the fascinating world of the Elliott Wave Forex Theory and see how it can amp up your FX trading game.

So, what's the deal with the Elliott Wave Theory?

Well, back in the 1920s, a guy named Ralph Nelson Elliott stumbled upon something game-changing. He discovered that stock markets don't move randomly; instead, they follow repetitive cycles. His theory suggests that these cycles are tied to the prevailing psychology of the masses and how investors react to external factors.

Elliott observed these patterns, which he called 'waves,' and they're based on the Dow Theory, stating that stock prices move in waves. He took it a step further by analyzing the market with a fractal perspective, where patterns repeat on different scales.

Now, what's a fractal?

Think of it as a never-ending pattern that repeats itself on various scales. Elliott found these fractal patterns in the market and used them to predict market movements.

Fast forward to today, and we've come to accept Elliott's Wave Theory. But back in the day, scientists were skeptical because the evidence he based it on wasn't recognized as science at the time.

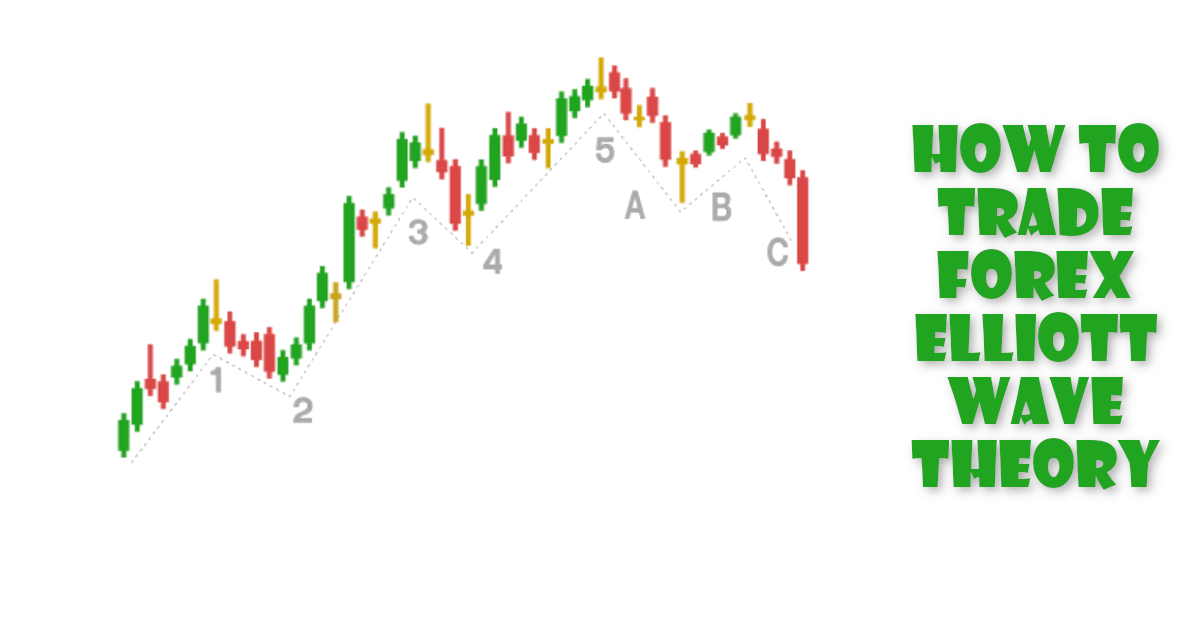

Elliott's theory involves 'waves,' each being part of a fractal. An 'Impulse Wave,' born from a main trend, consists of five waves within it, and each of those has five more waves, repeating infinitely. These smaller waves are classified as different degrees, although scientists didn't catch on to fractals until later.

Now, let's talk practicality. In financial markets, every action has an equal and opposite reaction. If gold prices rise, more people might sell, and if prices drop, more people might buy. Elliott used these balances and counterbalances to identify trends (impulsive waves) and corrections (corrective waves).

In Forex trading, Elliott's theory claims prices move in five patterns.

- In an upward trend, you get a five-way rise followed by a three-way fall.

- In a downward trend, it's a five-way fall succeeded by a three-way rise. These are 'impulse waves' and 'corrective waves,' respectively.

Applying the Elliott Wave Theory can be a game-changer in Forex trading. It helps identify market trends, the rise and fall of currency prices based on psychological factors, and trade participants' behavior.

Is it accurate?

Well, that's a bit of a debate in the trading community. Some swear by it, while others steer clear. It's crucial to understand that it's a theory, not a proven strategy. So, use it at your own risk.

In practical terms, combining the Elliott Wave oscillator with indicators like MACD and RSI can help define entry and exit points. It's not a magic bullet, but with practice, you might find it enhances your trading strategy.

Remember, demo accounts are your friends. Practice, practice, practice before jumping into the live markets. So, there you have it – a conversational rundown on the Elliott Wave Forex Theory. Happy trading!