Forex traders always have to make some decisions depending on the behavior of the market. They use a wide variety of technical tools and methods to analyze market. Trading strategies by FX technical analysis rely on market price historical data in order to predict the future. Here you can find out what FX technical analysis is about and how it can be used to forecast trends in Forex market.

What is Technical Analysis in Forex : Assumptions of Technical Analysis

Technical analysis is a method of predicting future market trends and price movements by analyzing market data and charts of past market changes. The most common type of information analyzed in FX technical analysis, is price data from the market. Technical analysis method looks for the basic trends, recorded and proved over a long time.

Technical analysis is built on a few assumptions:

- The actual market price reflects by changes in market's supply and demand, market sentiment, political factors and other market fundamentals.

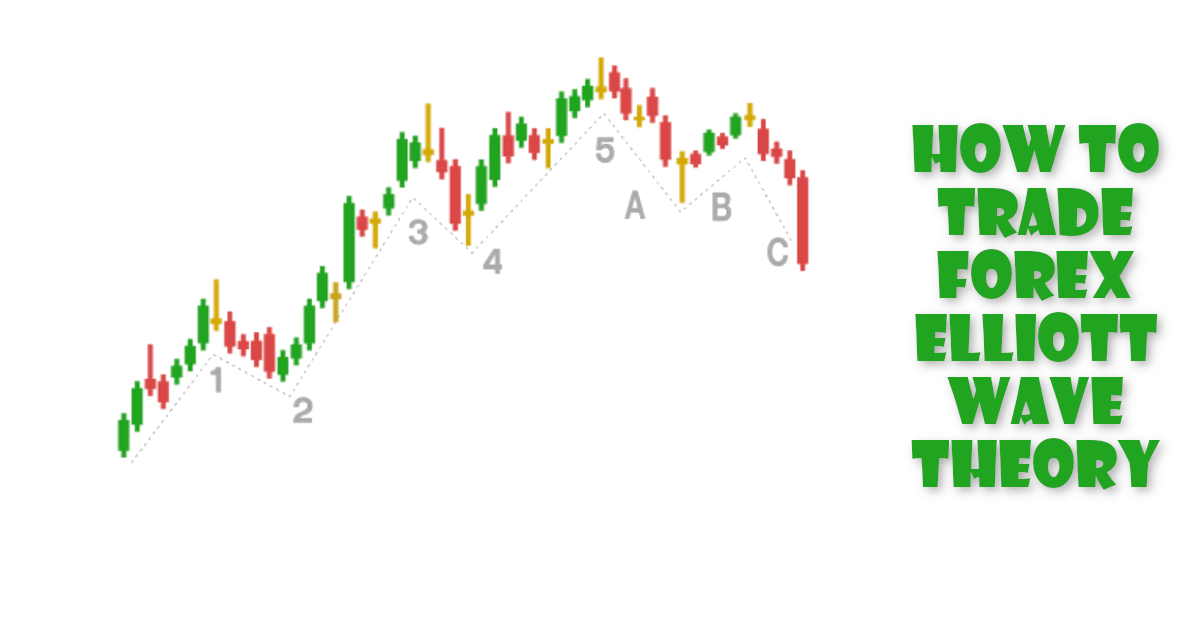

- Prices are moving according to the trends. Price fluctuations are not unpredictable and random. Price moves in trends that usually continue for a period after it was established. Technical analysis use trends to identify patterns of market behavior.

- History repeats itself in regular patterns, repeating structure of price changes. Based on the study of such structures produced trading signals. So, technical analysis is examining the past market signals to determine the current situation and predict the behavior of prices in the future.

What Are the Technical Tools Used by FX Technical Analysis?

FX technical analysis, like a fundamental analysis, tries to predict price movements. However, technical analysis does it by studying the effect of market movements. Technical analysis as a tool uses data charts of market actions that have already happened, whereas fundamental analysis tries to understand the reason of those actions. To have better results in market prediction, traders and analysts can combine FX technical and fundamental analysis.

A large amount of price historical data is available in the Forex market, which makes the use of Forex technical analysis tools such as technical indicators, trends and patterns valuable while forecasting future prices in this market.

Technical analysts use different combinations of technical tools to analyze signals in the Forex market and predict future changes of exchange rates. One of the tools of technical analysis are technical indicators - graphical representations on the price charts. Trend line, for example, can be used as a tool of technical analysis to determine the FX trend of price movement.

FX technical analysis is a great method and can be useful for Forex traders. Moreover, technical analysis tools can be used also by traders while trading in stock, commodity and other markets.

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Mobile. The company also offers MT4 platform available on PC, Mac OS, iOS, Android, Mobile and Smartphone. For comparison of the platforms, you can observe the advantages of both.