Traders Blog - Analysis, Strategies, News and more

Goldman Sachs to Buy NN Investment Partners in 1.7 Billion euros Deal

Goldman Sachs Group Inc. acquires the asset management division of NN Group NV, with cash revenues of 1.7 billion euros.The NN Investment Partners deal is expected to close by the first quarter of 2022 (NN said in a statement on Thursday). Satish Bap...

FED minutes and Jobless Claims

Global Markets fall; will that continue?Global markets fall right after publishing the FED minutes. What mostly markets picked up from FED minutes is that they will start tapering much earlier than prevouse expectations. As we read in the minute...

After weakness in data, the market is waiting for FED Minutes!

Markt is quiet and confused! As much as we are getting closer to FED minutes to be published, the market reacts more cautiously and brings more calm to see what policymakers think and then respond based on that. Kerry Craig, global market s...

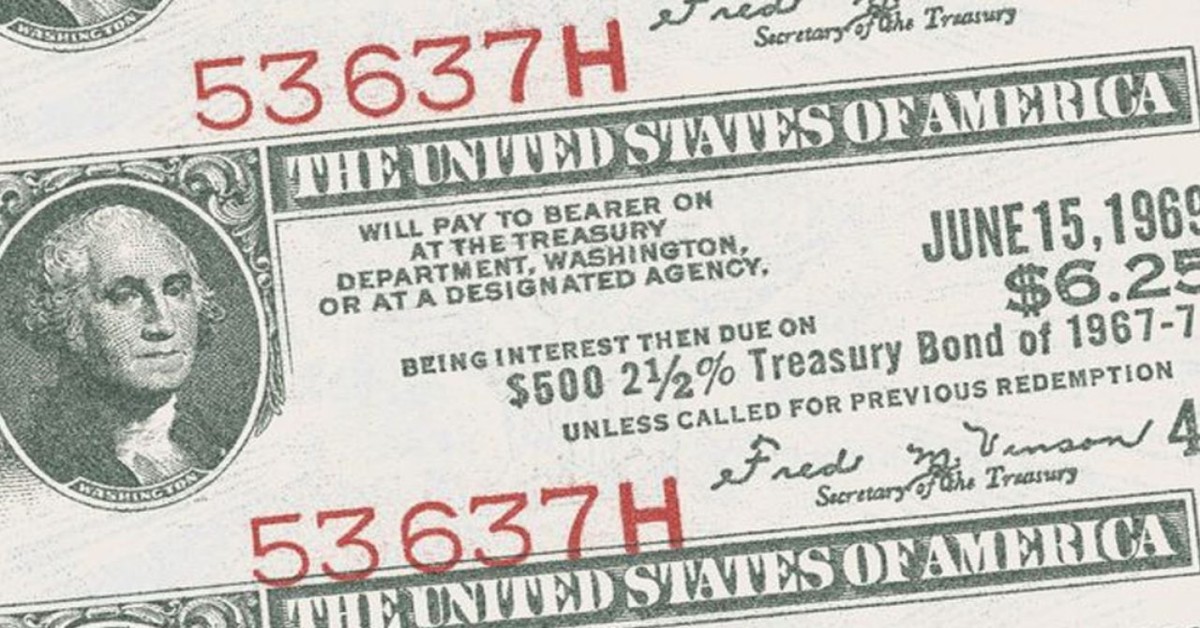

Treasury note yields back under 1.25%

USD and Stock market review! After increasing to new record highs in the late trading the previous day, today we are witnessing a decline in the future markets. Dow Jones futures were down 356 points, or 1.0%, while S&P 500 futures were down...

RBNZ meeting and expectations!

Can carry trade be a reason to hike the rates earlier!News Zealand surprised the markets earlier by announcing another lockdown. Jacinda Ardern, the prime minister, announced a three-day lockdown on discovering the first community case of Covid-19 si...

Tags

Subscription