Stocks back to weekly open, looking to close flat

US futures trading a bit higher to compensate for previous losses after testing recent two-month highs. In the last few days, most of the US Federal Reserve emphasized continuing interest rate hikes, while the US bond yield curve signaled a recession.

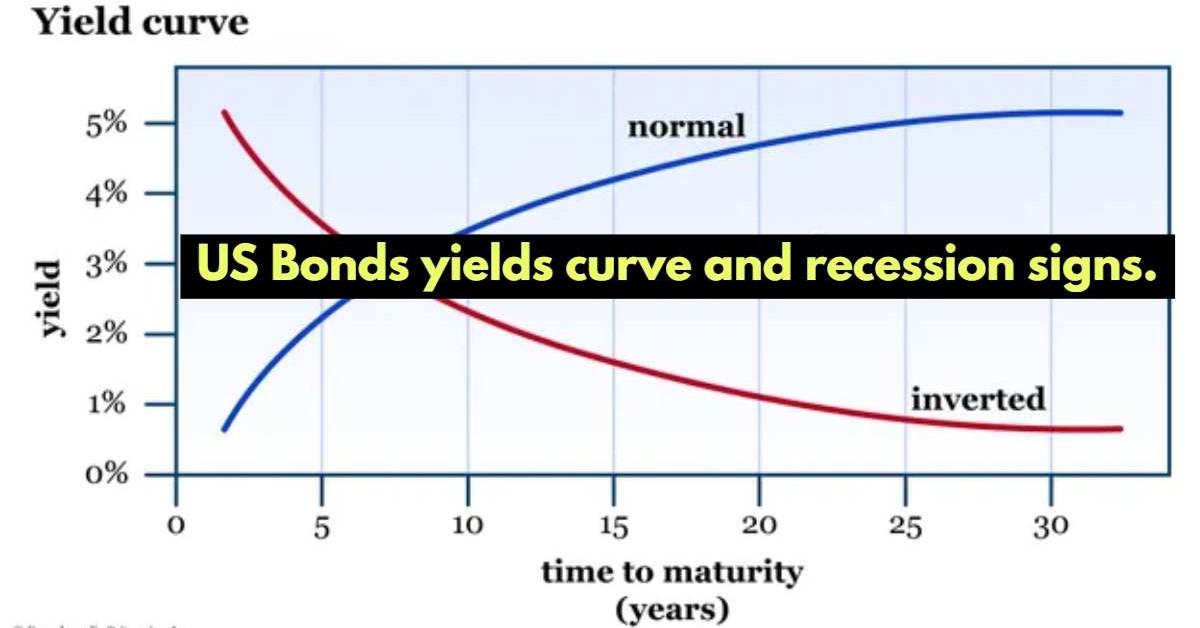

After recent comments from Fed officials, US two-year bond yields rose towards 4.50. While it is 23 basis points lower than November 3 high, showing 70 basis points spread with 10-year yields, which is the largest inversion since 1981 and an indicator of an impending recession.

While recession fears seem more real than ever, St. Louis Fed President James Bullard said interest rates might need to hit a range from 5-5.25% from the current level of just below 4.00% to be "sufficiently restrictive" to curb inflation. Therefore, we can still count on more tightening policies, which means that controlling inflation is preferable to economic growth. However, as we know actions speak louder than words, so it is better to wait for the Fed meeting, not count on any of these forecasts, and trade or invest with more caution.

After these data and reports, at the time of writing, the US dollar was flat against Euro and Japanese Yen around 1.0365 and 140, respectively. As data showed Japanese Core consumer inflation running at a 40-year high above 3.6%, now we can count on starting a U-turn in BoJ's monetary policies, which means Yen can gain some strength in the next weeks.

From the technical point of view, the USD index still moves in a downtrend in the Daily chart but is faced with strong support at 105.30. This is while in the smaller time-frames like in H1, the index is trying to confirm its return and bullish tendency. 20 EMA in a daily chart sits at 109.45 is the key pivot and returning above this level can push the bulls higher. On the flip side, failing to reclaim this level can increase the pressure on the US dollar index.