The highest pace of inflation since 1982 and FED Beige Book!

Yesterday's market reaction to the US data was the move in the opposite direction. According to the published data, the annual CPI in December, without seasonal adjustment in the United States increased by 7% in line with market expectations, to record a new growth rate since June 1982. With December 7% increase, now the average inflation is above 5% in the past eight months. On the monthly scale, mainly due to the soaring prices of used cars and trucks, we saw the largest increase since June 2021, with a 0.5% increase, above the 4% of market expectations. The seasonally adjusted core CPI in December excluding food and energy prices also hit a new high since February 1991, with a 5.5% pace of increase, and 0.6% monthly rate to hit a new high since June last year.

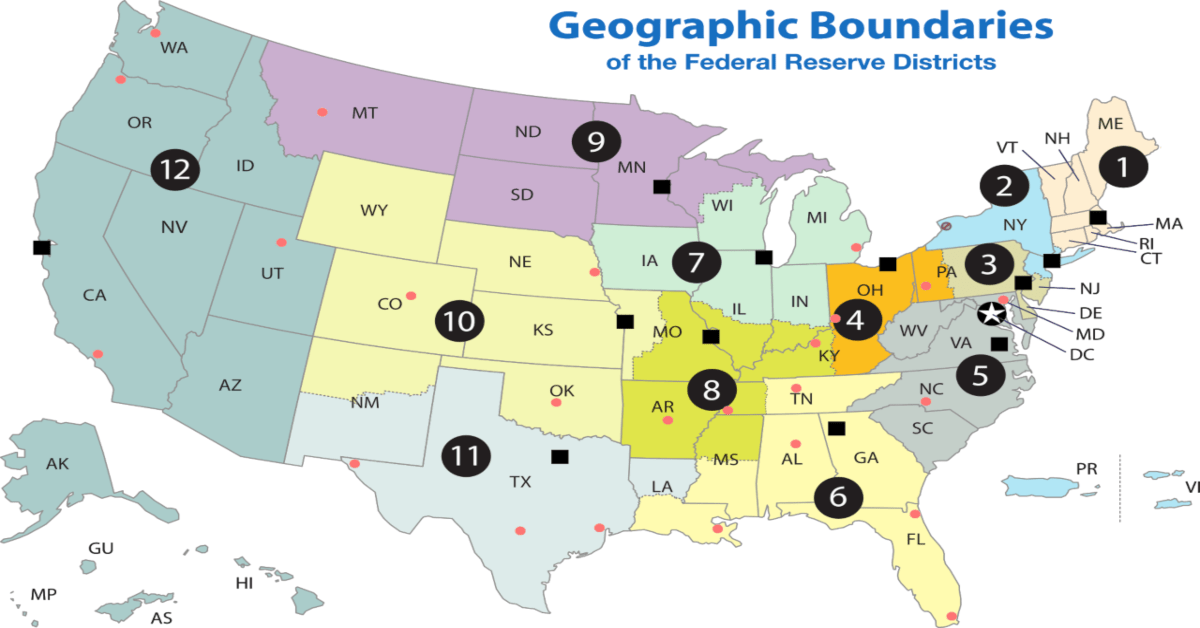

Yesterday, the FED Beige Book was also published. The report showed while the US economic activity is increasing at a moderate pace due to supply chain disruptions and labor shortages, more companies in different regions have lowered their growth expectations for the first months of 2022. Business owners of mostly service sectors, including tourism, hospitality, and restaurants. The main concern and reason for this weakness is the fast increase of coronavirus.

We can see this fast increasing inflation after Fed Chairman Jerome Powell told that FED trying to curb inflation without pausing the economic recovery from COVID-19. On the other hand, other FED members including Fed St. Louis President James Bullard Fed Bank of Cleveland President Loretta Mester, and Atlanta Fed leader Raphael Bostic also had a speech yesterday and all of them mentioned the need to faster rate raise as soon as March 2022. Considering published data and reports, now the market expectation for the first-rate hike increased to 74.4% compared with 68.3% a week earlier. Therefore, Inflation continues to remain the main concern for some investors and market participants.

Today, while we are waiting for the US producer inflation numbers, we should also follow the FED Speakers, including Richmond Fed President Thomas Barkin, Philadelphia Fed President Patrick Harker, and Chicago Fed President Charles Evans.

With published data, we can see that DXY was under pressure, while the expectations were exactly the opposite reaction. Technically, the US Dollar index is in a clear downtrend in all main charts. Currently, the pivot point sits at 94.95 with strong support at 94. Staying stable above the pivot point will change the direction with the important resistance at 95.50. With breathing above this level, we have to wait for 96-area.