Apparently, online currency trading became popular not long ago. The currency market is considered the largest financial market in the world, it is a multi-trillion dollar market. Historically, average investors did not have an opportunity to participate in the currency market, it was only available to large financial institutions, central banks, as well as hedge funds.

Thanks to the popularization of the Internet now individual investors can also benefit from trading currency in the foreign exchange market, which is free from any external controland is based on the supply and demand of a particular currency. Online currency trading brokers act as an intermediary between buyers and sellers and allow currency traders to access the 24-hour currency market. Read more about What is forex broker

Online currency trading

Online currency trading can be defined as the act of buying and selling different currencies. Currencies can be traded by retail investors, financial corporations and institutions doing business. This market is considered to be an Over-the-Counter (OTC) market, because it is run entirely through a network not on any centralized market.

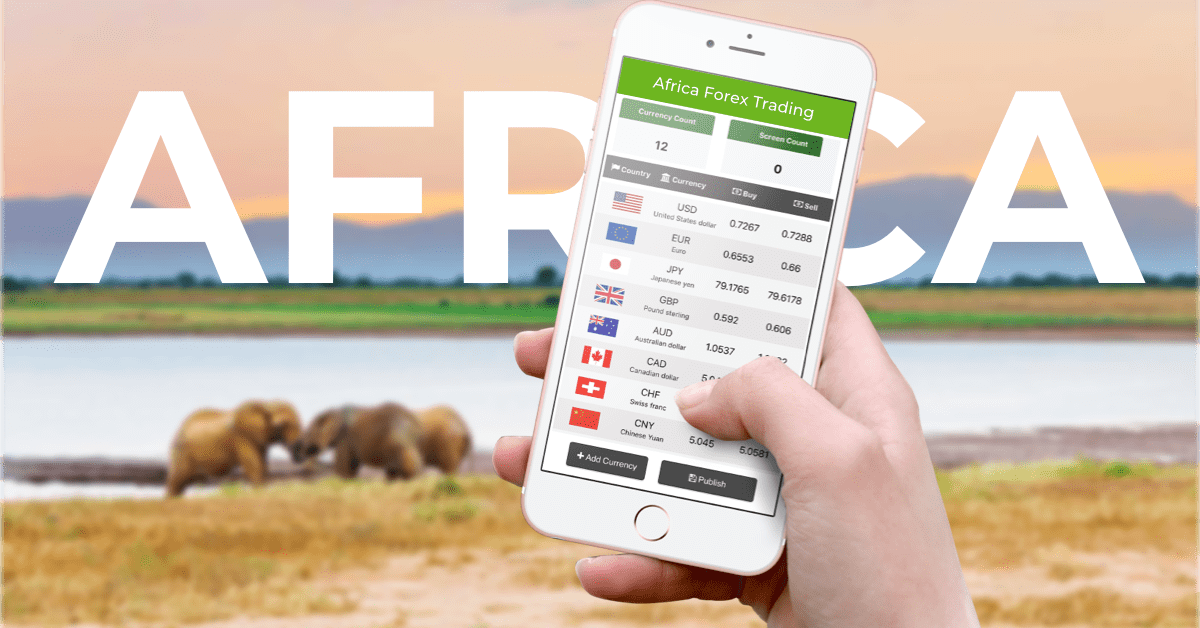

Currency traders attempt to make a profit in the foreign exchange market by taking advantage of the market movements. In Forex currency trading traders deal with currency pairs, not with separate currencies.The forex market is not like stock market, where traders can buy or sell a single stock, in this market traders buy one currency simultaneously sell another currency. Here are the currencies that are most often traded: EUR (Euro), USD (U.S. dollar), CHF (Swiss franc), JPY (the Japanese yen), GBP (British pound), CAD (Canadian dollar), NZD (New Zealand dollar), AUD (Australian dollar) and the most popular crypto-currency Bitcoin.

Online currency trading implies making Buy and Sell transactions in the Forex market, which is done by looking at the instrument price and deciding the direction in which the market is going to go in the nearest future. For example, if the price of the EURUSD pair is 1.5475/1.5477, and the trader wants to buy Euros he performs the transaction by the Ask price, which is 1.5475 here, whereas if the trader wants to open a sell position, he does it by the Bid price 1.5477. This is how investors perform online currency trading.

Forex Currency broker

A broker acting as an intermediary between the market and traders is called a currency broker which refers to a firm providing currency traders with access to a trading platform, where they perform trading operations with currency pairs.

The difference between Bid and Ask prices is called spread which is charged from a client as soon as he opens a position. Let us go back to the above example where the price of the EURUSD pair is as follows – 1.5475/1.5477, this means that the spread is $0.0002 (2 pips). It is valuable to do some research for finding out a broker that has a good reputation and trading conditions that meet your expectations.

Forex brokers allow their clients to use a practice account, which helps them to have some practice on the market and get ready to trading with real money. You should test out as many trading platforms as possible, because the trading platform offered by a forex broker is one of the most essential factors for your decision on which broker to choose. The trading platform is the place where you see the quotations of the instruments and place orders. There are several things to consider when examining a broker’s trading platform: ease of use, real-time quotes, instant execution and technical analysis tools.

Currency prices may change at any time, since they are influenced by so many factors, such as political, economic, and even natural disasters. In order to trade currency successfully in the forex market, you should learn as much as you can about the currency market before starting to trade, and continue studying this ever-changing market during the trades too.