The story started with Andrew Brunson, and now another currency crisis scares people!

The Turkish economy is one of the well-known developing economies. However, this country has been experiencing a bad fall in its currency value in the past months. Even though this critical situation caused a turn in their political relations to re-start the relations with Saudi Arabia and Israel, investors still look doubtful about the effectiveness.

During the Covid-19 pandemic, while most economies started to support their economies with more expansionary policies and lower interest rates, the Turkish Central bank increased the rates due to its debts to the international banking system.

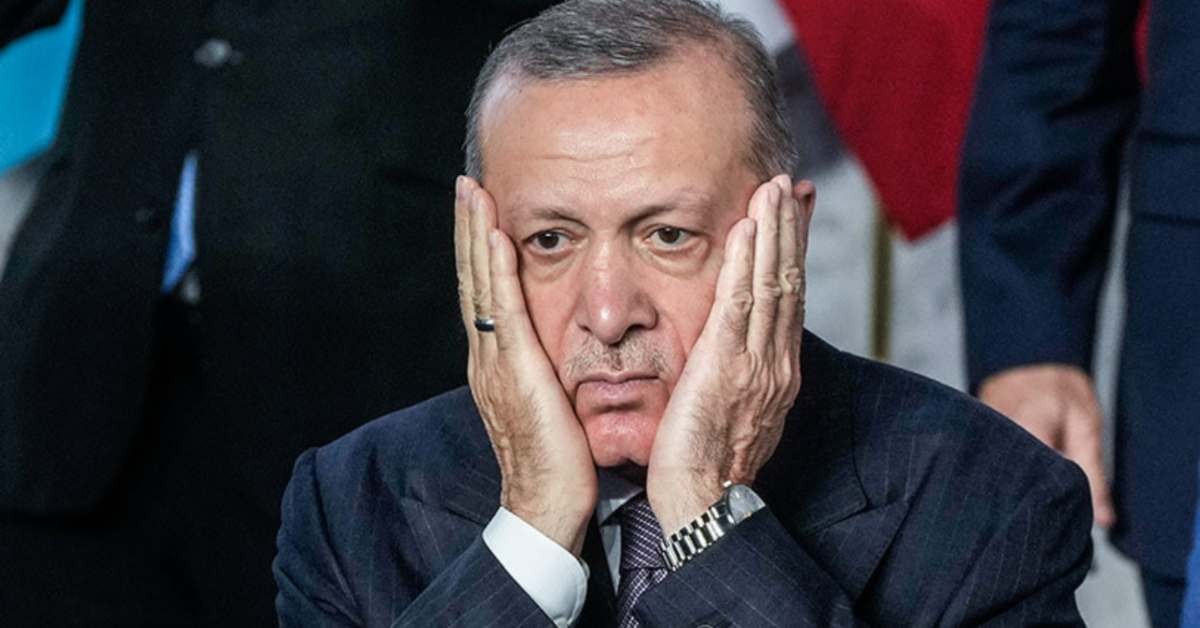

Of course, Turkey is not unfamiliar with the stories of the rapid devaluation of its currency value. Back in 2018, while Erdogan was trying to lower the rates and, with tighter control of monetary policy, was trying to push the economy against the concerns about economic fragility, detains of American pastors wasted almost all those efforts. Washington imposed financial sanctions right after Turkey detained American pastor Andrew Brunson on terrorism charges. This shock hit the currency, with the lira dropping 25% in August alone.

After this free fall in a month, the government tried to recover the currency value. In the short term, it was effective; however, the war in Surya and then Turkish military involvement in the Iraq conflict and Libya put much economic pressure on the government.

Frequent transfer of ministers in the Ministries of Economy and Finance did not prevent the increase in disappointments. At the same time, in 2020 and with the Covid-19 crisis, everything was prepared for a worse reduction. During the crises and lockdowns, the central bank increased the rates rapidly to 19.75% to support the currency, but it destroyed the economy. Finally, with another minister change, the government started to lower the rates. In recent months, this reduction in interest rates has again further weakened the lira, but inflation was the last blow to the half-dead body was the Turkish economy.

Higher inflation is not just in Turkey; with net foreign currency reserves profoundly negative, interest rates are at 14%. While the government and central bank are pledging to keep rates low, analysts say that country may be facing another currency crisis.

From the technical point of view also, it is still under pressure with USDTRY looking at 2021 December higher around 19.