Warnings that must be taken seriously!

Yesterday Eurozone CPI was worrying. Inflation in many European countries also continues to raise. What European Central Bank should do?

European inflation at 2.2% was not a concern until yesterday's published data. While the market participant used to worry about higher inflation in the United States, inflation in European countries has also continued to rise. Overnight, the Eurozone’s CPI increased by 0.4% Monthly base in August, much higher than market expectations at 0.2% and last month’s decrease of -0.1%. In terms of annual rate, at 3% was more than 2.7% of initial estimates, hit a new high since November 201. At the same time, Germany’s August CPI also soared to 3.8%, to stay at its 13-year high, the highest level since the country’s economic prosperity after reunification. In addition, France’s August CPI monthly and annual rates also increased more than analysts’ expectations and grew by 0.6% and 1.9% respectively, the highest inflation rate in the past three years. But in Italy, while annual inflation at 2.1% was not so much worrying, PPI at 10.4% in July, rang the alarm bells.

Let's check the details and see how much it can be risky! According to official data, and as we were expecting, energy was the main driving factor for higher inflation. Energy price increased by 15.4% annual base. The None-energy group increased just 2.7%. Inflation for Food, Alcoholic drinks, and Tobacco is about 2.0% year-on-year. And lowest interest was for Service sector with just 1.1%. Comparing with the same period of year ago, showing us a big difference in the energy sector, when the energy price had negative inflation by -7.8%. So the main reason for such high inflation is the change in energy price. So we can say the real inflation must be about 2.7% of the None-energy group inflation, still high, but less worrying.

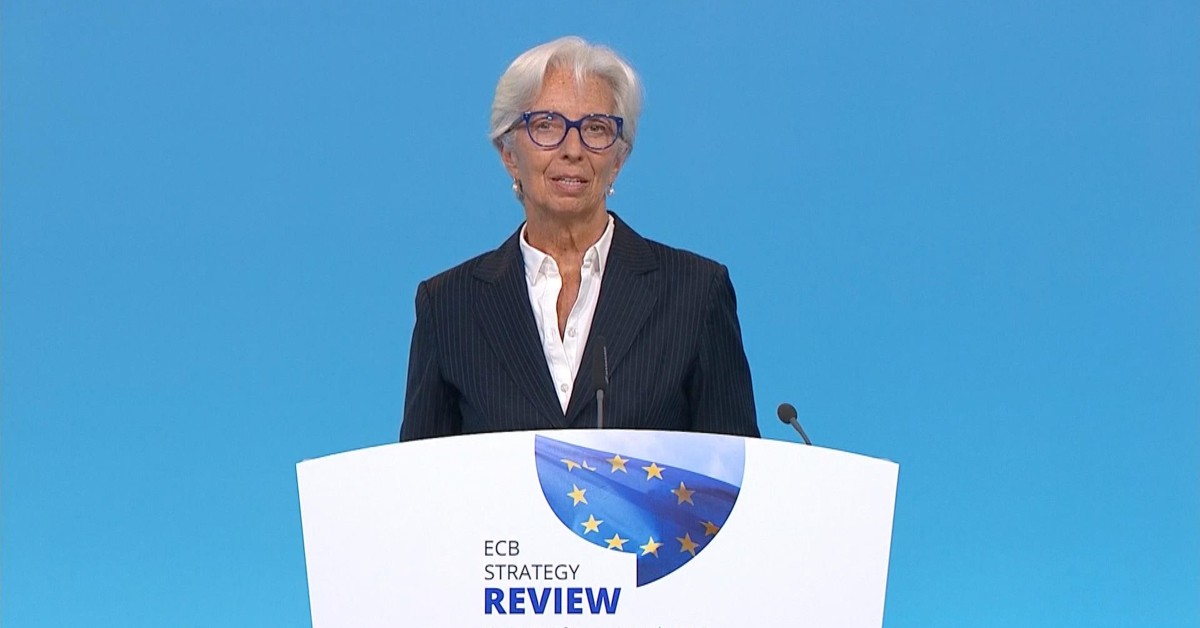

Now, the investor's focus must be on Next week's ECB monetary policy meeting and the press conference after that, where Mrs. Lagard will be answering the media. ECB's monetary policy seems more dovish than many other major central banks, and with the latest data and inflation worries, it is also possible now to see them having a bit dovish tone, at least in their statement. Recently, some ECB members had hawkish remarks that the central bank must slow down the Pandemic emergency purchase program (PEPP) in the fourth quarter, to end it in March next year.