A CFD or a Contract for Difference is one of the fastest-growing and the most famous financial instruments across the world. Generally, a CFD is defined as an agreement between two parties known as a buyer and a seller, who agree to exchange the difference between the opening and the closing prices of the contract. That is to say, in case the price of the agreement is positive, the seller pays to the buyer. And just on the contrary, if the price of the agreement is negative, the buyer pays to the seller. In comparison with other financial instruments, CFDs give traders and investors a chance of making profit by trading on the price movements of any financial instrument without physically owning it. Each day the number of people taking up CFD trading increases rapidly, which in its turn results in the appearance of various CFD brokers. In order to be able to choose the right CFD provider, traders should spend much time, do a good research and compare CFD brokers to see which one best corresponds to their trading needs and demands!

What to pay attention to when comparing CFD brokers?

The right choice of a CFD broker is perhaps one of the most significant components for starting to work in a long term based on trust. Because of the great number of CFD brokers, it has become a real problem to understand which one is the best. Nevertheless, there are some important features, which can somehow ease your task and help you when comparing CFD brokers. Here they are:

- The regulations of a CFD broker

- The service charges

- The spread type offered

- The types of CFDs offered

- The margin requirement level

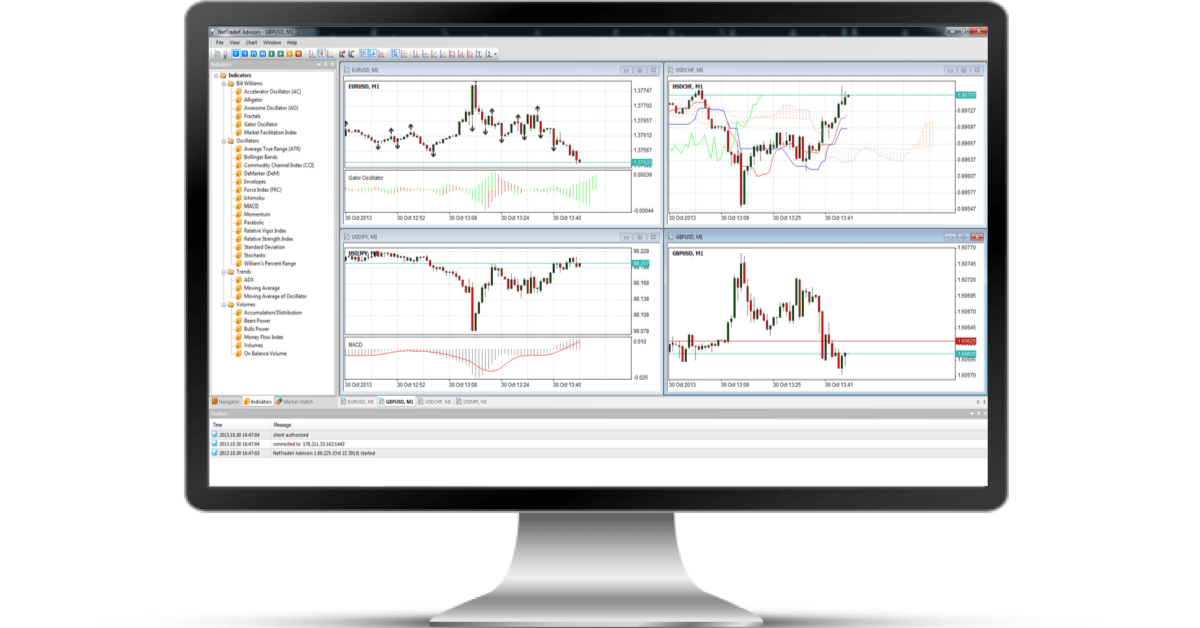

- The trading platform offered

- The risk management tools offered

- CFD account opening procedure

- Customer service

It goes without saying that this list is not the complete one, but these are the most important features that each reputable CFD provider should possess. And in case of paying attention to these features be sure that you will make the right choice when comparing CFD brokers.

IFC Markets, a leading Forex and CFD broker in the international financial markets, which has been steadily operating since 2006 in full accordance with international standards for brokerage services, absolutely possesses all the above mentioned features. Being regulated by the British Virgin Islands Financial Services Commission (BVI FSC), IFC Markets does its best to provide its customers with the best trading conditions: fixed spread, CFDs on highly liquid stocks, access to the most popular stock exchange markets (New York Stock Exchange, London Stock Exchange, NASDAQ, Australian Stock Exchange, Hong Kong Stock Exchange, Tokyo Stock Exchange, Xetra Deutsche Boerse),various risk management tools, two trading platforms: NetTradeX and MetaTrader 4, leverage up to 1:400, the opportunity of creating and trading your own trading instruments (PCI) and many more. Only with IFC Markets you can get the full benefits of trading in financial markets.