CFD or a Contract for Difference is a quite new trading instrument in the financial world, which allows traders/investors to trade on the price of the asset, going up or going down, without physically owning the asset. CFD trading is defined as a contract between two parties, known as a buyer and a seller. When the price of the underlying asset is rising, the seller pays to the buyer, and when the price of the underlying asset is falling, the buyer pays to the seller.

A Brief History of CFD Trading

CFDs were first originated in London in the early 1990s by Smith New Court, a London derivative brokerage firm, which was later on purchased by Merrill Lynch. CFDs were developed as a simpler way for hedge funds to short sell in the London Stock Exchange. At first, CFDs were used only by hedge funds, but as time passed on, it became also widely used by individuals.

The first company that provided CFD to private clients was GNI (Gerard and National Intercommodities). GNI offered its customers a number of CFD products and an innovative online trading system GNI Touch. Through GNI Touch the clients had a unique opportunity to get a direct access to London Stock Exchange and see live quotes of each asset.

Since 2002, CFDs have continued to become popular in other countries as well. The first country that opened its doors to the new trading instrument was Australia. Later on CFDs became popular in such countries, as Germany, France, Italy, Sweden, Norway, New Zealand, Portugal, etc.

Nowadays there are many brokers who provide CFD trading, and their number is increasing each day, due to the fact that more and more traders are discovering the advantages of CFD trading.

The Advantages of CFD Trading

In the last few years CFD trading has gained that much popularity among traders due to the fact that it is considered to be very beneficial and due to a number of advantages it offers to traders. Now let us list the main advantages of CFD trading.

- Trading on both rising and falling markets

- No Expiry date

- No stump duty

- Low commission

- Access to international markets

- The opportunity of using leverage

- Dividend payment

Starting CFD trading is not as easy as it may seem from the first sight. For being successful and for having constant profit one should have a good basis of knowledge on CFD trading and should find a reliable CFD provider, who offers only the best conditions to its customers.

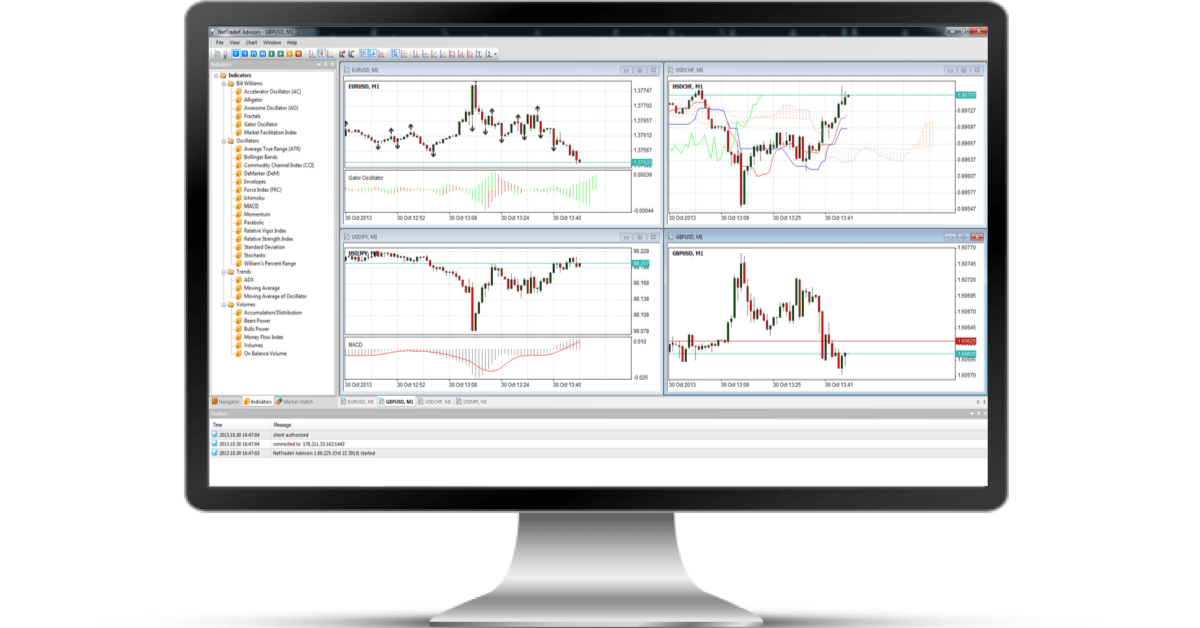

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Mobile. The company also offers MT4 platform available on PC, Mac OS, iOS, Android, Mobile and Smartphone. For comparison of the platforms, you can observe the advantages of both.