Derivative CFD instruments allow to trade without actually owning the underlying asset of the contract.

What Is CFD Trading?

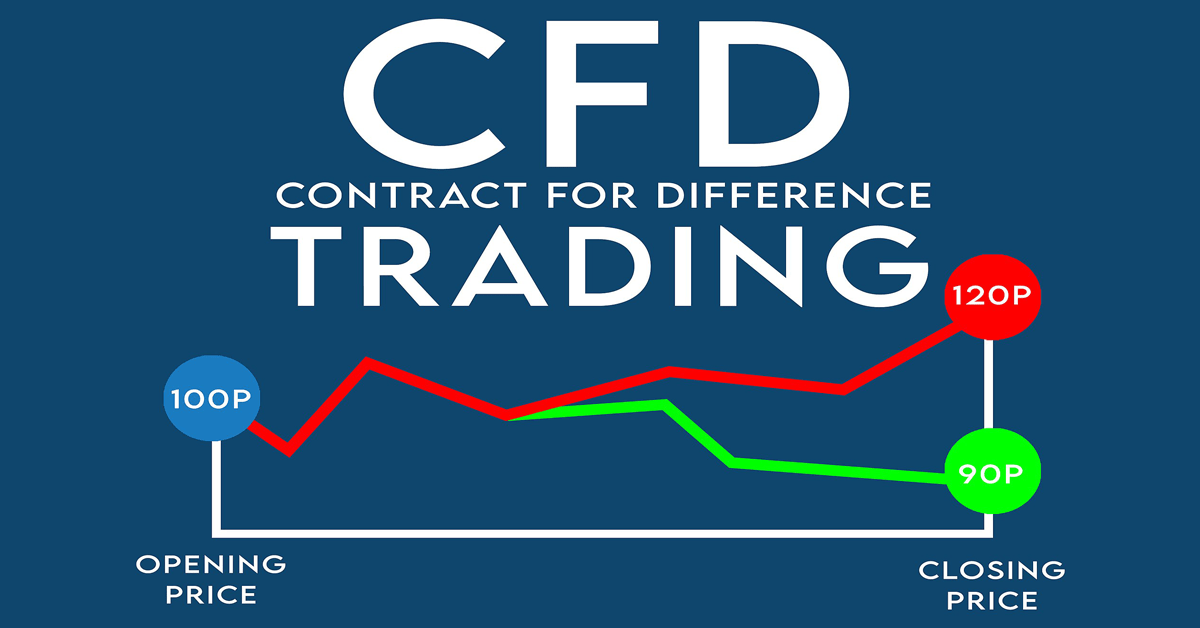

Contract for Difference or CFD is the agreement between two parties, based on mutual monetary calculation of the difference between the opening and closing prices of the contract. The difference between the opening and closing prices of the contract may result in either loss or profit.

CFDs are intended for speculating on the price fluctuations. In CFD trading it is possible to make profit both from rising and falling prices. In both cases either long or short positions may be opened. Traders choose long positions when the price is likely to increase in the future, and short positions when the price is expected to fall based on buying at a lower price. Short trading is difficult in the stock market, while CFD trading allows opening both long and short positions. With an appropriate trading strategy one can make a profit even in a falling market.

When choosing the position direction both parties predict an increase or decrease of the price of the asset. If the price of the asset has increased, the seller pays the buyer the difference between the initial price and the current price of the asset. If the price of the asset has fallen, the buyer pays the seller.

Benefits of CFD Trading

CFD trading provides numerous advantages over direct trading of an asset. Let us bring some of the main benefits of CFD trading:

- Possibility to increase profit by opening leveraged positions

- Opportunity to open long and short positions

- Quick access to different markets through one brokerage account

- Cost reduction due to the lack of taxes and hidden commissions

- Availability of large number of Commodity, Stock and Index CFDs

- Beneficial swap conditions

Main Procedure of CFD Trading

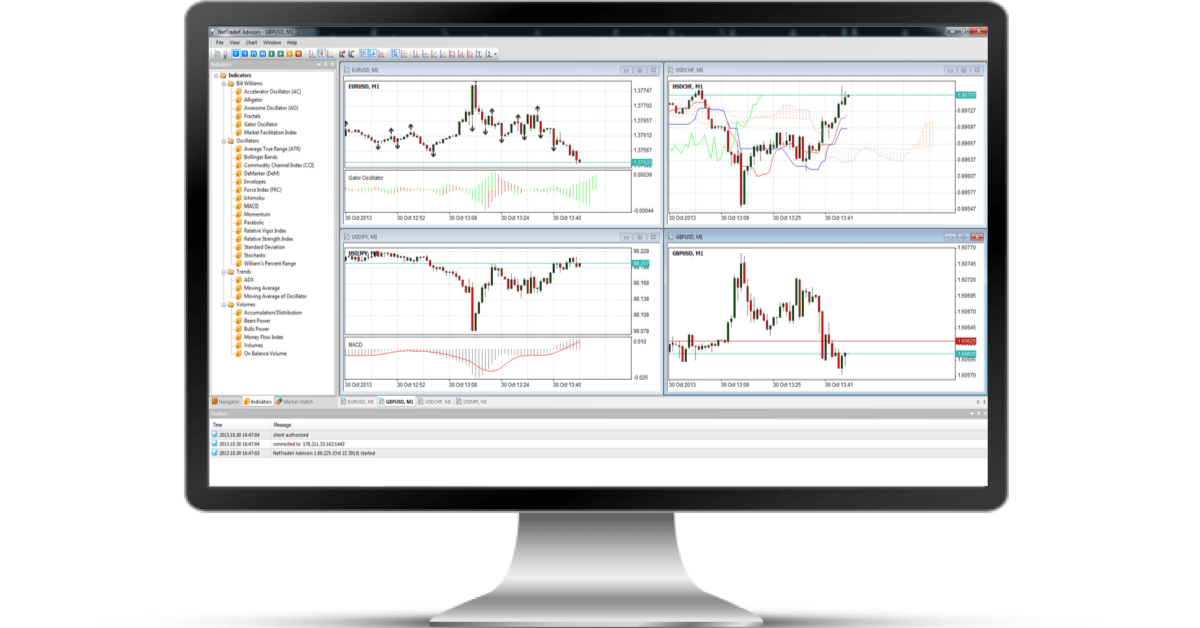

Through NetTradeX CFD trading platform traders have access to Commodity, Stock and Index CFDs, as well as numerous other trading instruments. The whole concept of CFD trading is very simple and is nearly identical with traditional currency trading. Traders buy CFDs expecting the price of the underlying asset to rise and in the same way they sell CFDs expecting the price of the underlying asset to decrease. This is the main process of CFD trading where traders make a profit or suffer a loss, depending on market fluctuations.

The overall concept of CFD trading is quite simple and in many features resembles the traditional currency trading. However, CFD trading has its own features and rules of trading to be followed to reach your trading goal.

IFC Markets is a leading innovative financial company, offering private and corporate investors wide set of trading and analytical tools. The company provides its clients with Forex and CFD trading through its own-generated trading platform NetTradeX, which is available on PC, iOS, Android and Windows Mobile. The company also offers MetaTrader 4 platform available on PC, Mac OS, iOS, Android, Windows Mobile and Smartphone. You may compare the advantages of both platforms.